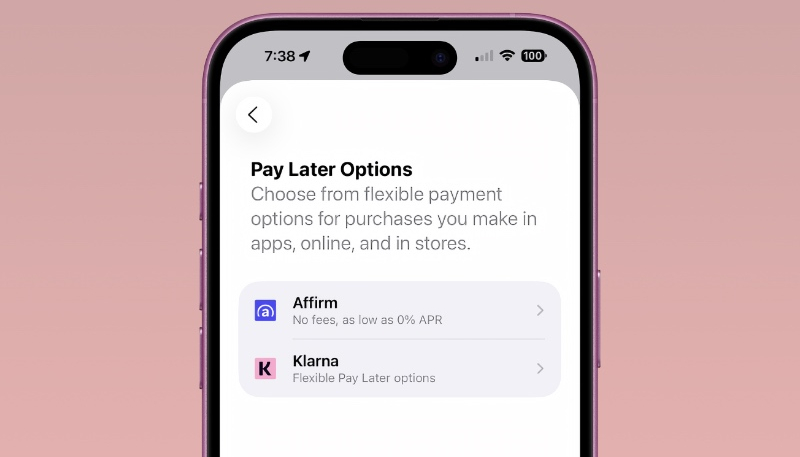

Apple Pay Later may not have been a success, but Apple hasn’t completely given up on the “buy now, pay later” market. A recent Wallet update makes third-party buy now pay later services easily accessible and manageable in the Wallet app.

Apple shut down the Apple Pay Later feature in 2024 after a short rocky life, that saw it never gain any real traction among consumers. Now, the company is handing off “Pay Later” customers to third-party companies installment providers, like Affirm and Klarna, both of which are now fully-integrated into the Wallet app.

The new Wallet feature, called “Pay Later Options,” rolled out to users in September 2025 across iOS 18 and iOS 26.

Users simply tap the “+” button in the Wallet app to view all supported installment provider, then set up accounts before checkout. The option to pay later was originally hidden inside the Apple Pay checkout process. Customers were required to tap “Other Cards & Pay Later Options” in the middle of a purchase, which likely deterred casual users from using the feature.

The update, first spotted by Apple enthusiast Aaron (via AppleInsider), comes just days before the iPhone 17 launch, in an apparent effort to link the new flagship handset with a streamlined financing system. iPhone’s are not cheap, and installment plans help relieve the sticker shock.

Installment providers like Klarna, Affirm, and others have become popular, as they allow consumers to split payments into smaller pieces. The services allow Apple to offer these installment plans without being required to take the lending risk.

Apple Pay Later was managed by Goldman Sachs, the Apple Card issuer, and failed due to delayed rollouts, regulatory pressure and other issues.

Buy Now Pay Later services have faced criticism and scrutiny over the last few years, as regulators and consumer groups have expressed concern over misleading marketing, hidden fees, and growing debt among consumers. Unfortunately, consumers are facing rising inflation, leading to more expensive items, leading to the need to spread payments over time, which leads to piling more debt onto the pile. Even food delivery service DoorDash is testing a system allows users to spread the payment for eligible transactions over time.